Stocks have kicked off the week in the green, while the Dollar is weaker so far on the day as it continues to consolidate near its recent cycle lows. The corrective phase we have seen over the last few weeks comes after the July FOMC minutes failed to feed the rally in risk assets.

There are hopes that the weekend’s vote on the US postal service could restart negotiations of a slimmed down stimulus deal, while on the geopolitical front, China are suggesting a review on the Phase One deal will take place. Coupled with optimism over Covid-19 treatments with stories that President Trump is mulling fast tracking a UK vaccine, there’s only one way for stocks to go, with US futures pushing northwards into unchartered territory.

One interesting chart floating about again over the weekend has been the Global Data Surprise Index which currently sits at an all-time positive extreme. Can this level of optimism be maintained, and does it make sense to be as bullish on risky assets with such a historic run of data surprises already in the bag? We need only look at Friday’s disappointing European PMIs to signal a potentially more difficult period ahead.

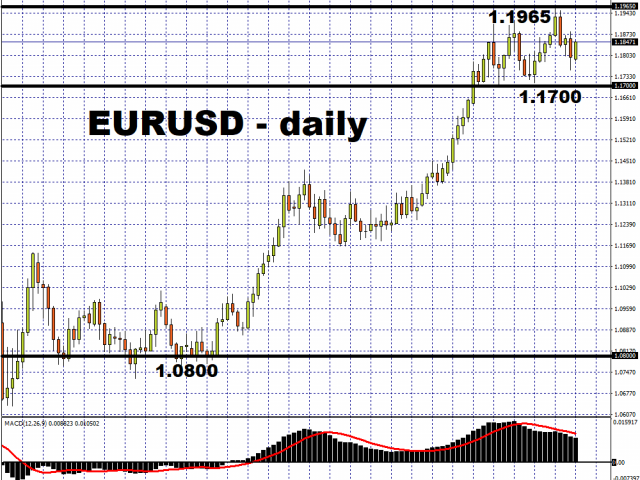

EUR bulls faced by fatigue

Traders are pondering last week’s softer data and also an increasing number of new coronavirus cases in various European countries. The former indicated that new lockdown restrictions are impacting on domestic activity. That said, the virus death toll remains low and the case spike commenced from very low levels amid the teeth of the summer holiday season.

We’re likely to see range trading ahead of the Jackson Hole meeting towards the end of the week when the great and the good of world finance gather (virtually) in Wyoming. The fundamentals for the EUR/USD move remain and only a decisive push below 1.17 will negate the long-term positive momentum. The recent high around 1.1965 offers resistance ahead of the psychological 1.20 level.

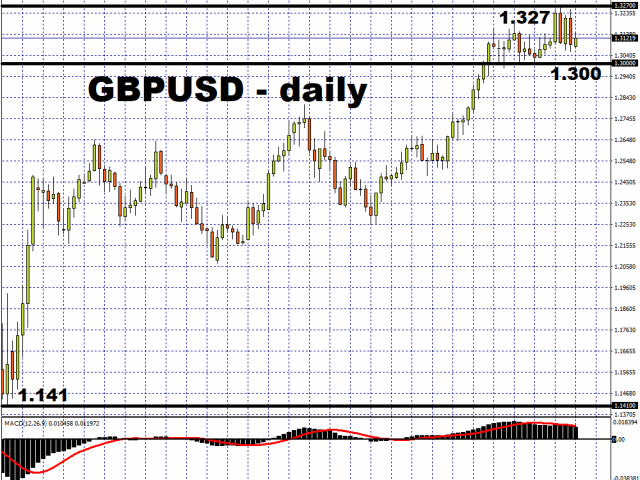

Cable fails again

The GBP/USD price action over the last few days has been interesting to say the least! Attempts at breaking above 1.3270 have proved unsuccessful and this has been helped by Brexit headlines pointing to very little progress, and even a feeling that talks are going backwards. Positioning data shows that speculators have been unwinding shorts and may now be flat too.

Strong support lies at 1.30 and only a close above those recent highs will see cable push on to new peaks on the way to 1.35.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.