Our commodity spotlight shines on Gold which is struggling to shake off the nasty hangover from last Friday’s painful selloff.

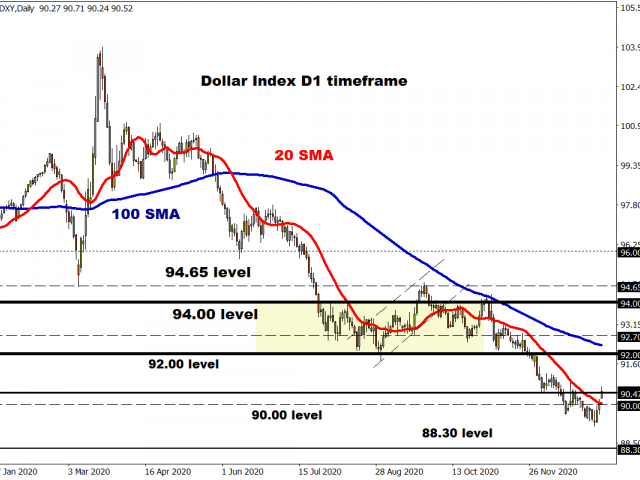

The precious metal has been bruised by an appreciating Dollar while rising U.S. bond yields rubbed salt into the wound.

For those who are wondering why this matters, Treasury yields have an inverse correlation with Gold. Given its zero-yielding nature and relationship with the Dollar, the next few days could be rough and rocky for the precious metal.

Since the start of 2021, prices have dropped almost 3% despite the global ‘reflation trade’ receiving a real kicker from the blue wave victory in Georgia’s Senate runoff. However, the battle is far from over for bulls amid the list of fundamental themes supporting appetite for Gold.

Given how Democrats have taken control of the Senate, hopes of further fiscal stimulus have risen. This is fuelling expectations over inflationary pressures making a return in the United States as consumption jumps. With the Dollar’s purchasing power poised to weaken as inflation rises, Gold which is seen as a hedge against inflation is set to benefit. When factoring in how the Federal Reserve is committed to keeping its ultra-accommodative monetary stance in place until at least 2023, the medium to longer-term outlook for the precious metal is bright.

It does not end here. Everything comes at a cost, even the handsome fiscal packages enforced by the government. The federal deficit surged to a record $3.1 trillion in the fiscal year of 2020, according to the Treasury Department. When a fiscal deficit arises, it impacts confidence in the economy and spurs safe-haven demand for Gold.

In our monthly outlook webinar for January, we discussed the possibility of Gold deriving strength from the ‘reflation trade’. Although prices look bearish in the short term with the downside fuelled by an appreciating Dollar, the medium to longer-term outlook remains bullish.

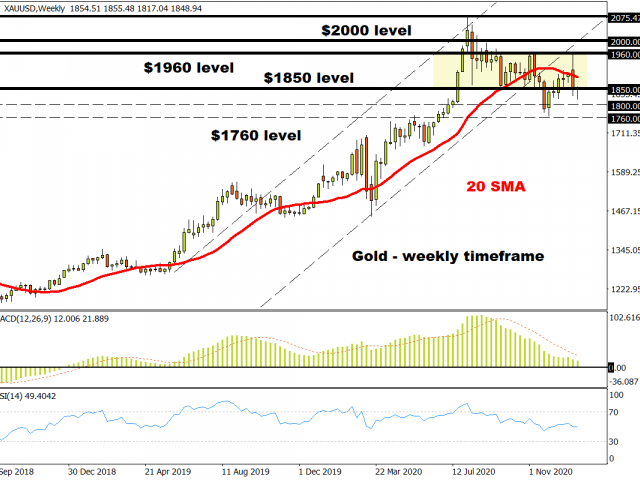

On the weekly timeframe, prices remain a very wide range with tough support around $1760 and resistance around $1960. A strong move back above $1850 could open the doors back towards $1900 while a breakdown below $1800 could signal a decline towards $1760.

Before dissecting the daily setup, check out the key market events in the week ahead which could influence Gold’s near-term outlook.

Focusing back on the technials, all eyes will be on how Gold behaves around the $1850 on the daily charts. A close below this level could encourage a decline towards $1820 and $1775. Should $1850 prove to be reliable support, prices may rebound back towards $1900.

Exención de responsabilidad: El contenido de este artículo incluye opiniones personales, y no debe ser interpretado como asesoramiento sobre inversión personal y/o de otro tipo y/o una oferta y/o solicitud de ninguna transacción con instrumentos financieros y/o garantías y/o pronóstico de rendimiento futuro. ForexTime (FXTM), sus afiliados, agentes, directores, responsables y empleados no garantizan la precisión, validez, puntualidad o compleción de ninguna información o dato disponible, y no asume ninguna responsabilidad por cualquier pérdida que resulte de cualquier inversión realizada en base a ellos.