Caution may be the name of the game on Tuesday as surging coronavirus infections across the United States whack risk sentiment and drain investor confidence.

Asian stocks are already positioned to conclude today’s session on a mixed note thanks to the growing anxiety over a surge in COVID-19 infections. Given how renewed tensions between the United States and China will probably compound to the growing list of negative themes fuelling risk aversion, equity bulls could be missing in action. For those who need further confirmation, just take a look at the futures markets – both European and US indices are in the red.

As the coronavirus menace spreads its poisonous tentacles across the largest economy in the world, investors are increasingly looking for a stimulus deal to be done. However, Republicans and Democratic have repeatedly failed to reach a middle ground with lawmakers set to postpone the Friday evening deadline for passing a bill. Considering the latest run of disappointing economic reports and how last week’s jobless data missed expectations, the absence of further stimulus is likely to weigh heavily on the US economy despite the vaccine optimsim. Since we are speaking about the U.S. let us take a quick look at the Dollar Index. Prices remain under pressure on the daily charts as there have been consistently lower lows and lower highs. The daily close below 91.00 may signal a further decline towards 90.00. Should prices push back above 91.00, the next key levels of interest may be found at 92.00 and 92.70.

In the United Kingdom, all eyes remain on the latest Brexit developments. After being smashed by uncertainty, Sterling pared overnight losses as the U.K. backed down from a threat to walk away from Brexit talks. UK Prime Minister Boris Johnson is set to travel to Brussels for critical talks with European Commission President Ursula von der Leyen. As the clock ticks down to the official transition deadline on the 31st of December, time is running out for a trade deal. These fears and concerns may translate to more weakness on the British Pound. We normally talk about the GBPUSD, but this morning let us take a look at the EURGBP.

The first word that comes to mind when looking at the currency pair is choppy. It looks like bulls and bears fiercely battle to gain control on a day-to-day basis. Prices are currently trading above the 0.9000 support level while prices are trading above the 200 Simple Moving Average. A solid breakout above 0.9100 could trigger an incline towards 0.9260. Should 0.9000 prove to be unreliable support, the next key level of interest may be found around 0.8850.

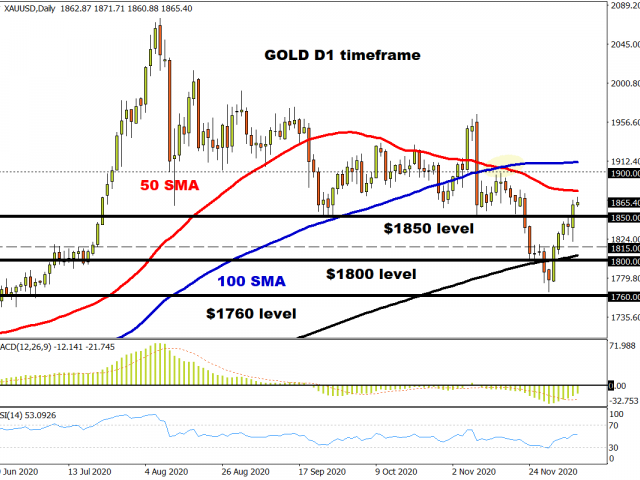

Commodity spotlight: Gold

It looks like Gold bulls are back in the game. The daily close above $1850 signals further upside with $1900 acting as the next key point of interest. If prices end up slipping back under $1850, the precious metal could descend back towards $1815.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.